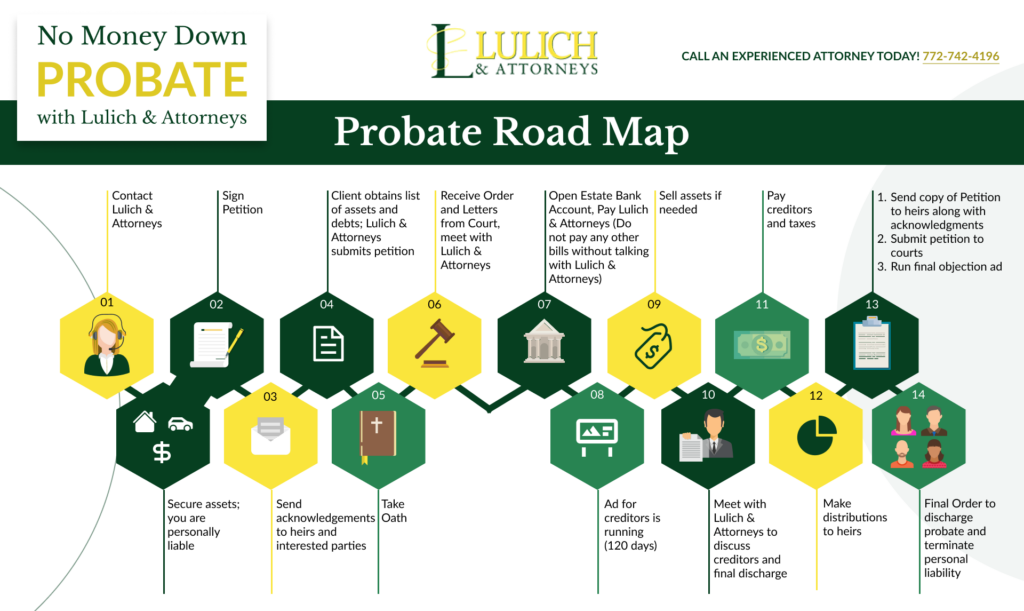

In general, the ancillary probate administration of Florida property follows the same progression from case to case. A personal representative of the decedent’s estate initiates legal proceedings by filing an oath to the appropriate court. Then, they may post bond, file the petition, give notice, and file the decedent’s death certificate.

These obligations are enough to make your head spin. That’s why, if you lost a loved one, you may consider partnering with a probate lawyer. They can guide you through the Florida ancillary probate administration process and fulfill your loved one’s last wishes.

What Is Florida Ancillary Probate?

To understand how ancillary probate works, it’s a good idea to know what this process is in the first place. Ancillary probate happens when a non-Florida resident passes away and wants to leave that property to someone in another state. This is common when snowbirds purchase vacation homes in Florida and only reside there for part of the year.

Each state has its own set of property laws. Because of this, the representatives of the estate must initiate a probate proceeding in each state where the decedent owned property. The state where the decedent lived does not have legal jurisdiction or the right to transfer property located somewhere else. Ancillary probate proceedings can occur simultaneously in each state for each piece of property.

How Ancillary Probate Administration Works in Florida

One of the first steps in an ancillary probate case is to determine who the ancillary probate representative is.

In Florida, the qualifications to act as a personal representative include:

- Being of legal age (over 18 years old)

- Not having a legal disability

- Being a resident of Florida

If the personal representative listed in the will doesn’t have the appropriate qualifications, it must appoint someone else as the ancillary probate representative. The decedent’s family could choose a local attorney to act as the ancillary personal representative.

The Personal Representative or the Attorney Can Give Notice

Once the estate determines the ancillary probate personal representative, they can file a notice of ancillary administration.

The notice must contain:

- The name and address of the ancillary personal representative

- The ancillary probate court where the case will occur

- The ancillary probate case number

- The county and state where the regular probate process proceedings are at

- The date when proceedings started

Then, the estate can file a Petition for Ancillary Probate, so the executor can receive documentation that the process has now commenced.

The Steps for Ancillary Probate Vary Depending on the Value of the Property

The value of the property in an ancillary probate case can greatly impact the steps to take. If the value of the property doesn’t exceed $50,000, the ancillary probate process is much shorter than if it is worth more.

Steps if the Florida Property’s Value Does Not Exceed $50,000

For properties worth less than $50,000, Florida law allows for a simple ancillary administration.

Here, the decedent’s personal representative:

- Files the will and other related documents with the county court where the property resides

- Send notices to creditors about the decedent’s death

- Resolve any outstanding debts (if applicable)

- Distribute the assets collected from the property to the decedent’s beneficiaries or heirs

As noted, an attorney can take these steps on behalf of the personal representative. Attorneys rely on their skills and insights to achieve their clients’ goals.

Steps if the Florida Property’s Net Value Exceeds $50,000

If the proceeds of the property are more than $50,000, the ancillary probate process could take longer. In this case, the ancillary personal representative must perform a full ancillary administration. This involves many of the same steps outlined in the previous section. Yet, the personal representative must adhere to additional supervision requirements, along with taking an inventory of the decedent’s property.

If you work with a probate lawyer, they can assess your property’s value and seek a fair resolution to the process. With legal guidance, you avoid making any mistakes that could prolong matters.

How to Avoid Ancillary Probate in Florida

There’s no avoiding ancillary probate if someone has already passed away and didn’t award property in their will.

However, they can prevent their loved ones from going through a long, drawn-out process by:

- Creating a living trust: To avoid probate for any asset, the property owner can create a living trust. Other assets they could add to the living trust include bank accounts, vehicles, and other real estate properties they own. Upon their death, the trustee can transfer the assets to the trust beneficiaries without going through the ancillary probate process.

- Owning property as Husband and Wife: To avoid probate for the property in Florida, the property owner can own the property as Husband and Wife. Specific verbiage on the deed of the property can make it where the surviving spouse automatically owns the entire property upon the death of the other owner. Taking this step can keep that property out of probate.

If the property owner of the Florida residence has passed away, a probate attorney can explain their family’s options. In some cases, going through the ancillary probate process is the only option. While arduous, following the state’s probate rules & procedures could offer a fair and prompt resolution.

What Does Ancillary Probate in Florida Apply To?

As noted, if a non-Florida resident owned property, and they didn’t have a will designating an heir, this property could end up in probate.

Examples of property in these situations include:

- Single-family residences, such as beach houses

- Ranches

- A condo unit

- Agricultural land

- Mobile homes, such as trailers and RVs

- Multi-family buildings

- Free-standing structures, such as boat houses

In some instances, personal belongings come into play. This generally doesn’t refer to the decedent’s personal effects, like their clothing. Yet, art pieces, jewelry, and other items may come into play. The decedent may even own property that they didn’t know was valuable, fueling familial conflict.

Factors That Influence How Long the Florida Ancillary Probate Process Takes

The length of time for a specific ancillary probate case in Florida varies based on different factors. In general, these matters last anywhere from one to two months. Some factors that could prolong your case’s progression include:

Whether You Secure Legal Help

Researching how ancillary probate in Florida works can quickly prove time-consuming. You could find yourself spending hours reading conflicting articles online or videos that don’t offer much insight. Rather than attempting to become a probate expert overnight, consider entrusting your case to someone who already knows about it. That way, you can focus your time on celebrating your loved one’s life not fighting over their Florida property.

The Estate’s Size

The estate’s size is one of the main factors that indicates how long ancillary probate takes. If the value of property in Florida is under $50,000, the process might not take as long than if it is over $50,000.

Think about the actual property in Florida and also the assets inside a residence. Other belongings subject to probate within the Florida residence could include valuable jewelry, art collections, and cash.

The Number of Beneficiaries

Some steps of the ancillary probate process require signatures and other documentation from all beneficiaries. When there are many beneficiaries, the time to receive and organize the required documentation takes longer.

If the beneficiaries all live in different areas of the country or in other parts of the world, it can extend the process. This is why some probate attorneys use eSignatures and other forms of electronic documentation. Through these methods, an attorney can get much-needed information in minutes, rather than having to wait around for snail mail.

Whether the Decedent Had a Will

If the decedent has a will, it can make for a faster ancillary probate process. This is especially true if they are very clear about their wishes and what to do with the property. Having clear instructions in the will can help to avoid disagreements among beneficiaries, which can also slow the process.

If there is no will present, matters can get complicated. Surviving family members may argue over who gets what. There could even be claims to the property that beneficiaries couldn’t have known about. These complications can make an initially straightforward process take months.

Whether the Will Is Legally Binding

Another issue with the will is if the decedent made mistakes.

Mistakes could include:

- Missing signatures

- Changes never put in writing

- Vague instructions

- Obligations falling on people who are no longer living (or capable)

- Disputes over the will’s validity

When someone passes away, they want their family to have time and space to grieve. They don’t want their spouse, children, and other family members fighting over their property. With a clearly outlined will, one can avoid going to probate altogether. Without one, matters take longer.

The Debts of the Decedent

If the decedent has unpaid debts, creditors could file claims against the estate. The estate must pay any creditors before they can collect or distribute assets. If a decedent had a lot of debts or liens, this could take time to resolve. Matters can get even more complicated if the decedent has debts but not adequate resources to pay them off.

Whether the Beneficiaries Agree on Certain Subjects

If the heirs fight over what happens to the Florida property, it could extend the ancillary probate process. Sometimes, these cases require mediation or other remedial procedures for the beneficiaries to agree.

Issues among beneficiaries that could slow down the ancillary probate administration process could include:

- Each beneficiary hired their own attorney. If the beneficiaries each hired their own attorney to look out for their best interests, it could extend the process significantly. Every time the executor makes a decision, the other beneficiary’s attorneys could question their decision, making each step of the process take longer.

- The beneficiaries don’t agree on selling the property. For example, some beneficiaries might want to sell a house as-is, while others might believe they could get more money if they remodeled it. For the beneficiaries to come to an agreement, it could take time.

- General disagreements among beneficiaries. If some beneficiaries have an issue with the will, they could contest it in court with the goal of invalidating it. If this happens, the ancillary probate process could go on for a long time until everything gets cleared up. In some cases, these issues only get resolved through long court trials.

When the beneficiaries agree on what to do with the Florida property, it can make the ancillary probate process smoother and, therefore, faster. Arguments and disagreements among beneficiaries could extend the process significantly.

An Attorney Can Handle Ancillary Probate Administration

To make the ancillary probate process easier and faster, it is helpful to seek the assistance of a legal representative. They can manage everything the process entails, from estimating the property’s value to filing all necessary paperwork.

They can also:

- Handle communications between out-of-state parties

- Decipher any complicated legal language

- Determine whether the decedent had a will

- Advise their client on their options

- Check all documents and paperwork for completion and accuracy

- Work out an agreement that satisfies all involved parties

- Notify creditors of the decedent’s passing

Your attorney could be the only person that shares your legal goals. Others fighting over the property and creditors may not.

When to Consider Contacting an Ancillary Probate Lawyer

You should consider hiring an ancillary probate lawyer at the first sign of trouble. An experienced probate lawyer can assist you with a range of responsibilities, including managing the legal process, ensuring compliance with applicable laws and regulations, and advising you on complex legal matters. Many law firms recommend hiring a probate lawyer from the very beginning. That way, your lawyer has total control over the legal process and can advise you accordingly.

You Should Consider Legal Representation as Soon as Possible

There are many deadlines that come with ancillary probate cases—some of which aren’t exactly clear. Even missing one of these deadlines could spell problems for your case. This is yet another reason to consider working with a lawyer. Someone who understands the probate process inside and out can ensure you meet all applicable deadlines. They can also see whether any exceptions shorten or lengthen certain filing periods.

An Attorney Can Assist With Your Florida Ancillary Probate Administration Needs

If you’re the executor of an estate, and the decedent has a property in Florida, your case could require ancillary probate administration. An attorney can assist in closing your case, so you can administer the assets to the other beneficiaries. Your lawyer knows this is a stressful process. For that reason, they take necessary measures to help make this as smooth and quick of a process as possible.

Many attorneys offer free consultations. You can learn more about your specific circumstances and get information about your case today. Once you start working with a Vero Beach estate planning lawyer, they can get to work immediately. Because your case comes with many time-sensitive aspects (such as filing deadlines and evidence collection), it’s a good idea to consider your options sooner rather than later.